How to file VAT Return in UAE and Pay Vat

VAT Return Filing in UAE:

Value Added Tax, called VAT, is implemented in UAE from Jan 1st, 2018. In first phase Vat is implemented in UAE and KSA which make Vat Return Submission in UAE a mandatory activity, however the other GCC countries will implement Vat in in 2019 as per reports as of today. Bahrain already approved the Vat law while Oman is expected to implement Vat in Sep 2019. The crux of Vat Return in UAE or in any country is to submit Vat report, called Vat Return Submission, to relevant authorities, the documents is called Vat Return while the process is called Vat Return Submission, in UAE relevant authority is called Federal Tax Authority (FTA). In this article we will discuss how to file the Vat Return or UAE Return Filing with FTA.

Where to Submit:

Under UAE VAT, the businesses are divided in to various categories depending upon their size, hence the first vat return filling was in Feb followed by March, April till June 2018. The first VAT return was due on 28th Feb, 2018 for companies which are required to submit monthly VAT return. The businesses are required to make VAT Return Submission online using the Federal Tax Authority (FTA) portal. The FTA portal is designed to accept the Vat returns only through online mode until further information. This implies that the taxpayer is required to manually provide the values of Sales, Purchase, Output VAT and Input VAT etc. in the appropriate boxes of the VAT return form available in FTA portal.

Vat Return Submission Form:

The UAE VAT Return is required to submit using a form, called ‘VAT 201’ available on FTA portal. The Form VAT 201 is broadly categorized into 7 sections as mentioned below:

• Taxable Person Details

• VAT Return Period

• VAT on sales and all other outputs

• VAT on expenses and all other inputs

• Net VAT Due

• Additional reporting requirements

• Declaration and Authorized Signatory

There is another form called “Vat Voluntary Disclosure Form 211” to be filled under certain circumstances (not required to file unless you have made a mistake in VAt Return Submission earlier). Each of these sections contain various boxes in which the taxpayer needs to furnish the details in order to complete the VAT Tax Return filing. Each of the above sections and the details required to be furnished in relevant boxes of VAT Return Form 201 are discussed below.

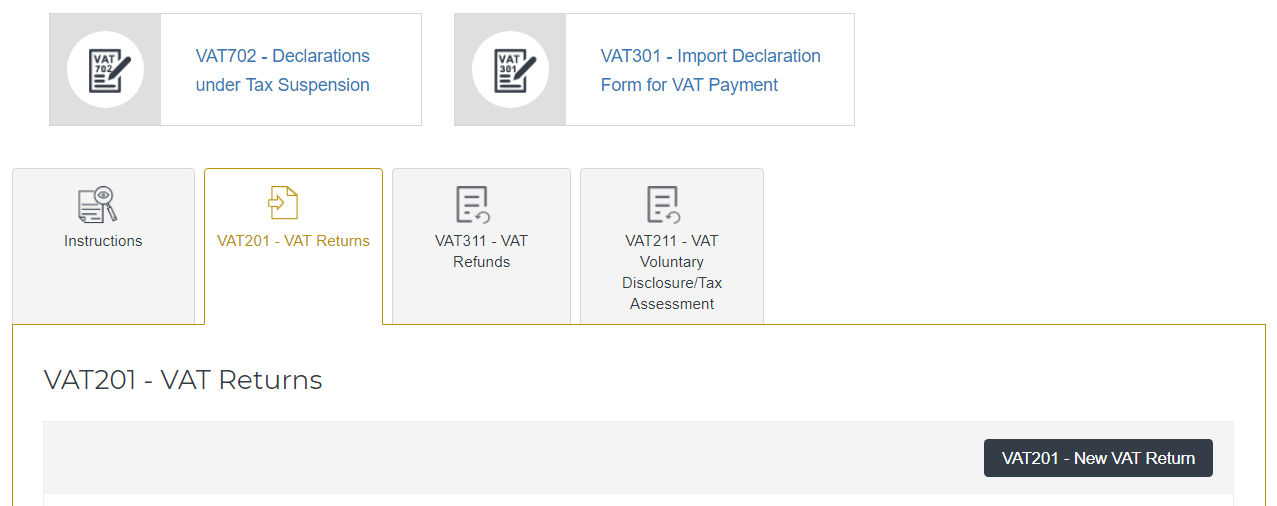

To access the VAT Return Form 201, the taxpayers should log in to the FTA e-Services portal using their registered username and password. Form Navigation menu, select the ‘VAT’->VAT 201- VAT Return->click on ‘VAT 201-New VAT Return’ to initiate the VAT return filing process.

On clicking ‘VAT 201- New VAT Return’ as shown in the above image, various sections of VAT return form will open. Let us explain the process step by step to filing the VAT Tax Return in Dubai.

![]()

![]()

![]()

![]() 1. Taxable Person Details

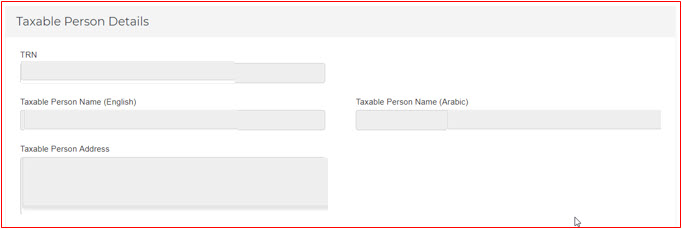

1. Taxable Person Details

In the above section, details such as the “TRN” or “Tax Registration Number” of the taxpayer, as well as their name and address will be automatically populated. If a tax agent is submitting the VAT return on behalf of a taxpayer, the details of TAAN (Tax Agent Approval Number) and the associated TAN (Tax Agency Number) along with the Tax Agent and the Tax Agency name are populated at the top of the VAT Return automatically.

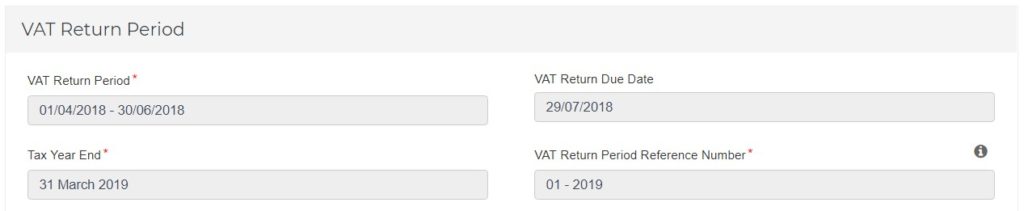

2. VAT Return Period

The details in the above section such as VAT Return Period for which you are currently filing a return, the Tax Year end, VAT return period reference number and VAT return due date will be auto-populated. The tax year end is important for businesses who are not able to recover all of their input VAT and need to perform an input tax apportionment annual adjustment. Such adjustment is allowed only in the first return following the tax year end. VAT return period reference number indicates the VAT return period which you will be completing within that tax year. If the VAT return period reference is 1, those businesses should include their input tax apportionment annual adjustment in that VAT return. Businesses need not worry now, because this is applicable after 1st year of VAT return i.e. from 1st January, 2019 onwards.

The details in the above section such as VAT Return Period for which you are currently filing a return, the Tax Year end, VAT return period reference number and VAT return due date will be auto-populated. The tax year end is important for businesses who are not able to recover all of their input VAT and need to perform an input tax apportionment annual adjustment. Such adjustment is allowed only in the first return following the tax year end. VAT return period reference number indicates the VAT return period which you will be completing within that tax year. If the VAT return period reference is 1, those businesses should include their input tax apportionment annual adjustment in that VAT return. Businesses need not worry now, because this is applicable after 1st year of VAT return i.e. from 1st January, 2019 onwards.

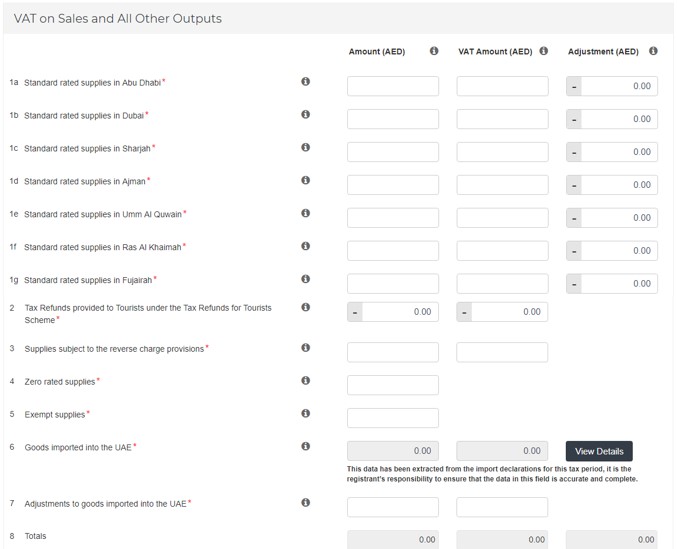

3. VAT on sales and all other outputs

3. VAT on sales and all other outputs

In the above section, you need to furnish the details of standard rate taxable supplies at the Emirates level, zero rate supplies, exempt supplies, supplies subject to reverse charge mechanism etc. If you have any confusion on it, you can contact any Vat Consultants in Dubai.

In each of the above lines, we would like to add some information for your read reference and ease.

Line-1a to 1g: Input the sales value (net of vat amount) in the first column emirates wise, what does it mean. Place of supply determine that which emirates the number will go. The rule of thumb is, sales goes to the emirates from where the supply is made, it can be your fixed establishment office or your warehouse away from your fixed establishment.

Line-2: Tax are applicable to most of the approved retailers under Tax Refund Scheme, it will not impact any other business. More details to follow.

Line-3: In this line you will input the products and services which are imported via non-customs route, it means via courier companies or services rendered/purchased from abroad or online. All other imports which passes through customs will be populated automatically under line 6.

Line-4: Input supplies (sales) made at Zero Rated, in other words exports outside UAE.

Line-5: Input supplies (sales) which are exempt from Vat, for example supplies in education or medical treatment or property sector under certain conditions.

Line-6 & 7: This line will automatically populate the imports made via customs. There is possibility that imports records as per customs does not match with books of accounts, in this case, any adjustment should be incorporated in line 7.

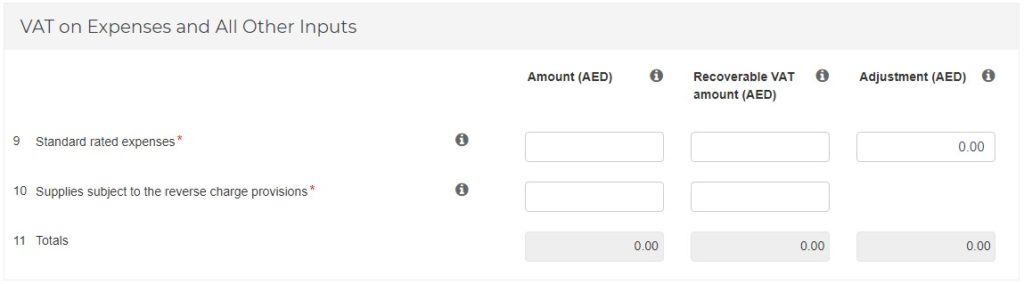

4. VAT on Expenses and All other Inputs

In the above section, you need to furnish the details of purchases or expenses on which you have paid VAT at a standard rate of 5% and supplies subject to Vat Reverse Charge basis along with the eligible recoverable input tax. In line9, input expenses and purchases subject to standard rate of 5%. Please remember total of line#3 # 6 should match with amount in line 10.

5. Net VAT Due

This section indicates your VAT payable for the VAT return period. The line12 reflects total value of output which line13 shows your input recoverable tax. The amounts will be calculated based on the information declared in Sales, purchases and all other sections. The line14 indicates the tax payable to government for the period. This will be the difference between the total tax due for the period (line12) and the total recoverable tax for the period (Line13). Either it will result in net VAT payable or recoverable tax.

If the amounts in line12 is more than the amount in line13, the difference is the amount of VAT that is payable by you, however it the amount in line12 is less than the amount in line13, then you will be eligible to request a refund for the net amount of recoverable tax or carry it forward to the subsequent VAT return period.

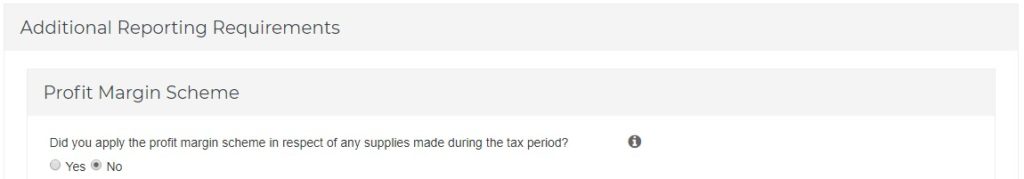

6. Additional Reporting Requirement

This section is applicable only for businesses which are operating or using the provisions of the Profit Margin Scheme during this period, in other cases just tick ‘No’ and proceed to the next section. This is just an additional reporting which does not have any financial impact on your VAT Return.

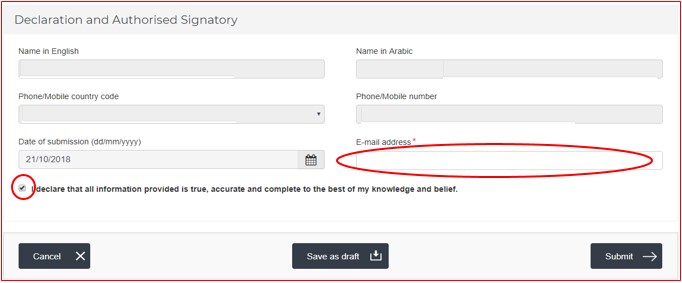

7. Declaration and Authorized Signatory

In the above section, provide the authorized signatory details and tick the box next to the declaration section to submit the VAT Return. The taxpayer also has an option to save the details as a draft and submit it later. Before submitting the VAT Return, the taxpayers have to take utmost care in verifying all the details and only when he or she is certain that all the information is correct, click the submit button. After the successful filing of the VAT Return, taxpayer will receive an e-mail from FTA confirming the submission of VAT return form.

8. Payment of Vat to FTA

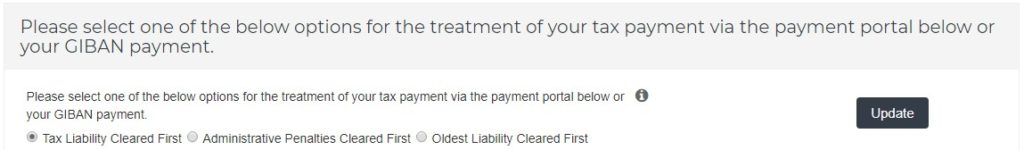

Please note, the process does not end on clicking submit button on the portal, the actual payment of Vat amount to FTA is the second and final step to complete the Vat Return Submission and Payment Process. After submission, please navigate to tab “My Payments” as show in above screen shot, select the appropriate button to indicate where you want to apply that payment first.

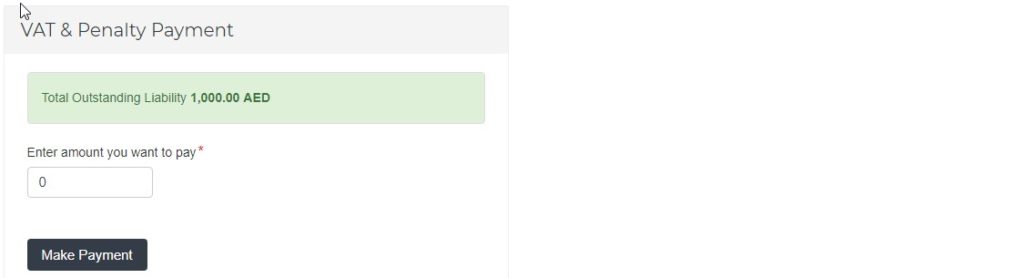

Navigate further down on the “My Payments” page, see the above section to make the actual payment online. Fill the amount mentioned in the green section, click Make Payment button and choose appropriate method and pay. Alternatively, payments can be made via exchange houses in UAE using companies GIBAN number.

Conclusion

The VAT Return filing in UAE requires accurate summary of details, the detail vat working of Sales, Purchase/Expenses, output VAT and Input VAT can be made separately. Make sure your details produce an accurate summary of figures to be incorporated in the required Vat Return format prescribed by FTA.

If you observe, in certain lines of the vat return, the amounts are not just consolidation of detail sales or purchases and resulting vat. In fact, it requires accurate treatment of business transactions with respect to vat. For example, standard rated sales are required at the Emirates level, the taxpayer is required to furnish only those expenses or purchase on which he is eligible to recover the input VAT etc.

It will be highly difficult for business to manually collate and compile transactions for filing VAT Return. By doing so, business always carry risk of risk of missing output or input vat reporting or deadlines which eventually lead to non-compliance. Therefore, we highly recommend maintaining proper Accounting and Bookkeeping for your business, any Bookkeeping firm in Dubai can help you in case you don’t have in-house resource. Further to it, Bookkeeping and Accounting is not possible without using a simple accounting software, there are many Bookkeeping firms in Dubai or Vat Consultants in Dubai and UAE who can guide you on it.

Important note and Disclaimer

The guide and explanation in the above article do not form our opinion in any form whatsoever. Therefore, before using the guide and concepts explained in the article, we highlight recommend to seek expert Vat Advice & consultancy from auditors in Dubai or Tax consultants in UAE.

It is important to note, after going through above guide, it seems Vat Return Filing and Vat Payment to FTA is simple, however it is not the case, right treatment of each and every business transaction with respect to Vat is the base and pre-requite for accurate tax reporting and compliance. A Vat Consultant in Dubai or anywhere in UAE can advise you on case to case basis and as per nature of the business.

Therefore, we highly recommend to seek, if not already, support of an expert tax or VAT Consultant in UAE to advise you throughout tax journey. Our next article will talk about how to choose a right Vat Consultants in Dubai and what are the pre-requisites for accurate Vat tax reporting and vat return submission. We will also guide you how to maintain Books of Accounts since Accounting and Bookkeeping in UAE becomes very critical after introduction of Vat. Bookkeeping in Dubai, was not a subject to discuss earlier, however now there are many Bookkeeping firms in Dubai who are engaged in helping businesses to streamline their books. We will talk on it later.

Therefore, we highly recommend to seek, if not already, support of an expert tax or VAT Consultant in UAE to advise you